Deep Learning models are quickly transforming the economic landscape of stock prices prediction. This new form of artificial intelligence (AI) technology is leveraging the immense computing power of modern computers to process vast amounts of data, allowing stock market traders and investors to make faster and more accurate financial forecasts to optimize their investments. Deep learning is a form of AI that uses multiple layers of neural networks to process data. Each layer builds on top of the previous layer by processing more intricate features, such as patterns in the data or complexity. Deep Learning algorithms can learn complex relationships, predict trends, and make smarter decisions more quickly than traditional methods. Due to its immense data-processing capabilities, Deep Learning can be applied in stock price prediction in a variety of ways. Firstly, Deep Learning models can be used to quickly identify patterns related to stock price movements. By using multiple layers of algorithms and data sources such as news, historical trends, and market sentiment, Deep Learning models can provide far more accurate predictions of stock performance than traditional methods. The Deep Learning model can also detect signs of manipulation and fraud among stock prices, helping to protect investors from being taken advantage of. By using existing financial data combined with other types of indicators, such as corporate insider buying, Deep Learning models can detect patterns that indicate suspicious activity, which can then be tracked or preempted.

The Problem

The mining industry is a complex and dynamic field, with thousands of junior mining companies vying for investors' attention. In this crowded market, it can be difficult for investors to separate the signal from the noise and identify the key drivers of stock prices. For this case we have identification of drivers of ca. 3000 junior mining companies stock prices within up to 100 new daily specialized articles / news related to production and drilling results, permissions.

Our Solution

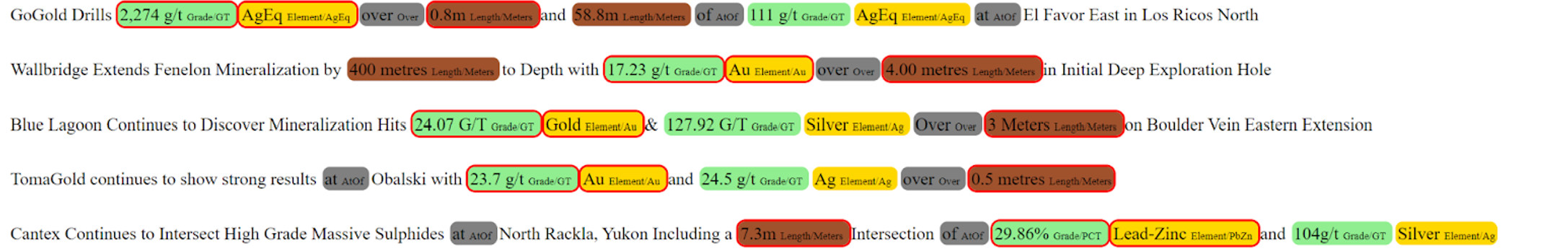

One solution to this problem is to use deep learning to analyze the vast amount of data available on junior mining companies, including production and drilling results, permissions, and news articles. By training a deep learning model on this data, it is possible to identify patterns and trends that can be used to predict future stock prices with a high degree of accuracy.

Solution is cloud-based architecture that consists of asynchronous data structuring and analytics pipelines that constantly track latest news which are the basis of stock prices predictions. Due to complexity and length of drilling results articles the forecasting is based on the Longformer, a modified Transformer architecture with a self-attention operation that makes it easy to process long documents.

Outcome

One approach is to use an email and dashboard alert system that can notify investors of important news and updates related to specific junior mining companies. This system can also include stock price predictions, with a forecast accuracy of around 70%. This approach can help investors to stay informed and make more informed investment decisions, while also providing a valuable tool for monitoring the performance of their portfolio. It can also help to identify opportunities for investment in undervalued junior mining companies, and to avoid potential pitfalls.

Key Takeaway

Analyzed 100% of the news data, evaluated its impact on price with up to 70% accuracy.

Overall, the use of deep learning to identify the drivers of junior mining companies' stock prices can be a valuable tool for investors looking to navigate the complex and dynamic world of mining. With the right approach, it is possible to stay informed and make more informed investment decisions, while also identifying opportunities for growth and avoiding potential pitfalls.

![[object Object]](/lib_gRnApgvCOvsXNYsy/3t99fsmvfqveuvr5.png?w=102)